michigan gas tax revenue

Getting gas can be pricy depending on the vehicle and oil market but in Michigan drivers could be forced to shell out more at the station if a. Michigan Gas Tax Revenue Brochure Author.

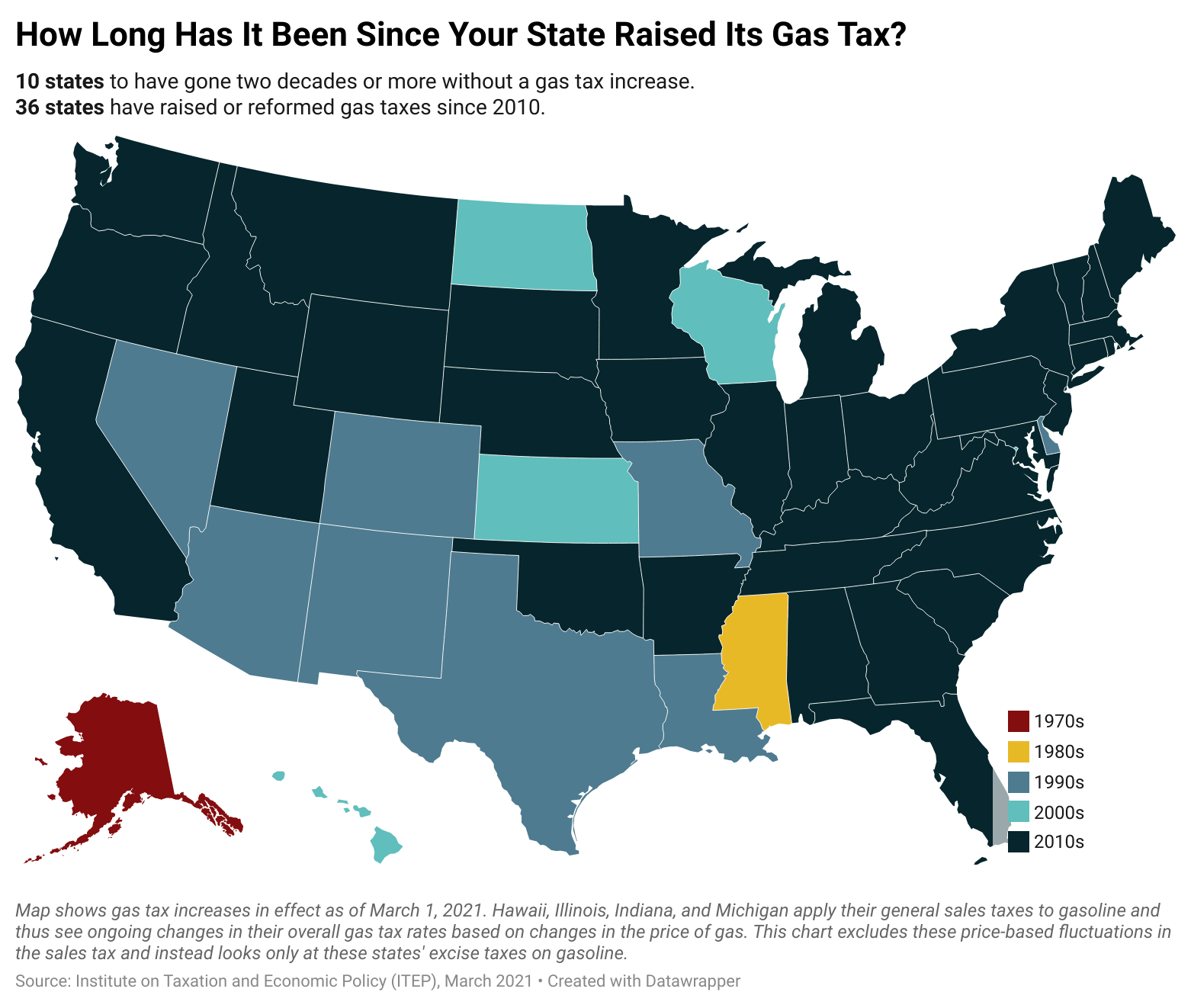

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Where the Money Goes.

. When will I receive my refund. During the first nine months of FY 2007-08 sales tax collections from gasoline sales are running ahead of the FY 2006-07 level by 249. Combined business tax collections from the Single Business Tax.

MTF Reports Act 51 Allocations Michigan Transportation Fund MTF payment breakdown information related to individual monthly payments to incorporated cities villages and county road commissions pursuant to Act 51 new revenue package estimated revenues and monthly and annual reports. Currently state gas taxes range from 1432 cents per gallon in Alaska to 6205 cents per gallon in California not including the 184 cents per gallon federal gas tax they wrote. Approximately 44 billion taxable gallons of gasoline were consumed in Michigan in 2011.

SCHOOL AID FUNDReceives approximately 238 of gross collections per 2020 PA 75. February 201517 Sales Tax 76088 341 Use Tax 14482 65 Individual Income Tax 83955 377 State Education Tax 18453 83 Business Taxes 6559 29 Tobacco Taxes 9175 41 Lottery 7600 34 Other GFGP SAF Taxes 6578 30 Estimated FY 2015-16 Total 222898 million. Individual Income Tax 70394 676 Sales Tax 13176 127 Net Business Taxes 6794 Use Tax 5945 57 Non-Tax Revenue 3504 34 Tobacco Taxes 1821 17 Other GFGP Taxes 1371 13 Liquor Beer and Wine Taxes 1110 11 REVENUE SOURCE AND DISTRIBUTION House Fiscal Agency August 2018 Page 11.

Account Services or Guest Services. Senate Bill 768 would have lowered the individual income tax rate to 39 and created a 500 tax. The revenue Michigan received from its motor fuel tax MFT in fiscal year 2018 was 226 billion of which 259 percent or 5879 million was diverted to the.

Michigans excise tax on gasoline is ranked 17 out of the 50 states. Michigan Gas Tax Revenue Brochure Created Date. WILX - Governor Gretchen Whitmer vetoed an income tax bill Friday and says she intends to veto a proposed gas tax suspension upon receipt.

You may check the status of your refund using self-service. Gas purchases generated an estimated 6532 million in sales tax revenue. The Michigan gas tax is included in the pump price at all gas stations in Michigan.

There are two options to access your account information. Call center services are available from 800am to 445PM Monday Friday. At this pace sales tax collections from gasoline sales will top 8000.

REVENUE ECONOMIC DATA. Explaining the Price of Gasoline - Fall 2014. The Michigan Senate this week gave final approval to a bill that would suspend the states 272-cents-per-gallon gas tax for six months but the Republican majority did not have enough votes to give the bill immediate effect meaning it would not cut prices until 2023.

Previous SFA Analysis on Gas Prices and Motor Fuel Taxation. Michigan Taxes tax income tax business tax sales tax tax form 1040 w9 treasury withholding. Motor Fuel Tax Return filing deadlines have not changed.

For general questions please email TreasMotFuelmichigangov. At this level of consumption and an average pump price of 350 per gallon the sales tax on gasoline sales would have generated approximately 8183 million in. Effective November 1 2020 through November 30 2020 the rate for gasoline was established at 104 cents per gallon and the rate for diesel fuel was established at.

MiMATS users should continue to use the MiMATS eServices portal. In most areas state and federal excise taxes amount to about 13 of the cost of a gallon of gas. Gas stations generally only profit a few cents per gallon.

If you use Account Services select My Return Status once you have logged in. GFGP Tax Revenue House Fiscal Agency. This rate will remain in effect through April 30 2022.

Michigan Gas Tax 17th highest gas tax The Michigan excise tax on gasoline is 1900 per gallon higher then 66 of the other 50 states. The Michigan Severance Tax Act MCL 205301 levies a tax on oil and gas severed from the soil in Michigan. Effective April 1 2022 the new prepaid gasoline sales tax rate is 202 cents per gallon.

The revenue Michigan received from its motor fuel tax in fiscal year 2018 was 226 billion of which 259 or 5879 million was diverted to the states School Aid Fund. When you create a MILogin account you are only required to answer. 2015 PA 179 earmarked 1500 million of GFGP income tax revenue to the Michigan Transportation Fund in FY 2018-19 3250 million in FY 2019-20 and 600 million in FY 2020-21 and each year thereafter.

Michigan Cigarette Tax 11th highest cigarette tax. Producers or purchasers are required to report the oil and gas production and the value in a monthly return. Gasoline Prices and Taxes in Michigan - MayJune 2000.

Sales Tax and Gasoline - May 1 2006. Date sales tax revenue was up 181 from last year and 1222 million above the predicted level while use tax revenue was down 52 from last year but 318 million above the predicted level. Michigan severance tax returns must be filed monthly by the 25th of the month following the production.

Pin On Interesting News From Anywhere

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

U S State And Local Motor Fuel Tax Revenue 2019 Statista

Gov Inslee S Just Proposed Dec 2016 Carbon Tax Would Dedicate A Majority Of Revenue To Funding Education Clean Energy Education Revenue

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

Largest Private Convenience Stores And Gas Stations U S 2020 Statista

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

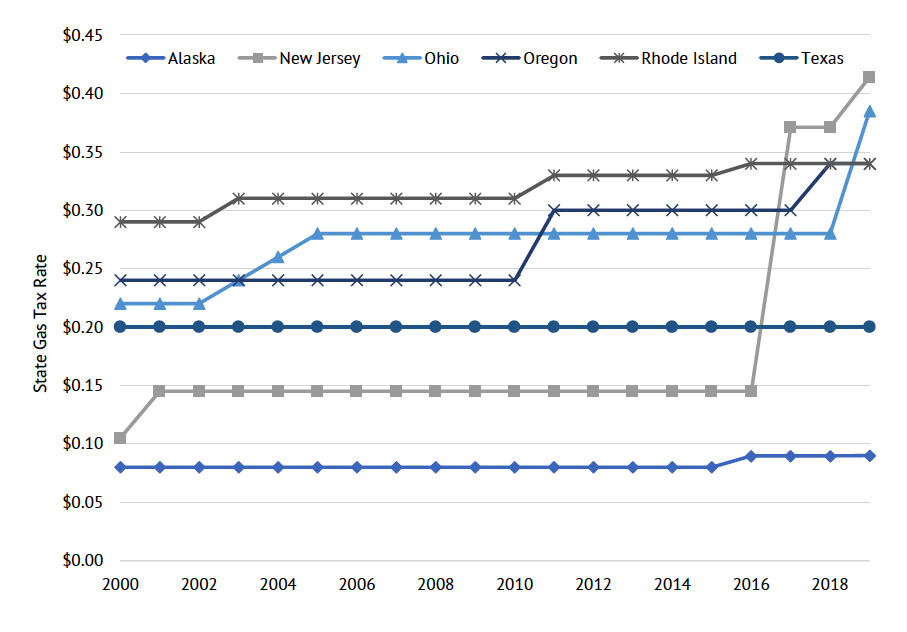

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Google Requested To Label Anti Fracking Websites As Fake News Oil And Gas Gas Industry Oil Jobs

U S Tobacco Tax Revenue And Forecast 2026 Statista

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Lawmakers Eye Pause In Michigan Gas Tax As Prices Soar But Which Tax Bridge Michigan

Most States Have Raised Gas Taxes In Recent Years Itep

U S State And Local Motor Fuel Tax Revenue 2019 Statista

Where The Money Goes Road Commission For Oakland County

Michigan Sales Tax Where Does The Revenue Go And What Could An Increase Mean For Road Funding Mlive Com